Two-thirds (62%) of self-employed people have no pension savings, according to a report by investment firm, Fidelity.

The report, titled Generation Self-Employed, suggests that people working for themselves may have to work later in life than those who are in employment.

According to Fidelity, two-thirds of the self-employed population are also struggling financially.

The rise of female freelancers

The report found that this struggle is particularly felt by women, a quarter of whom said they had so little in savings they were concerned they would not be able to afford to take time off to have a baby.

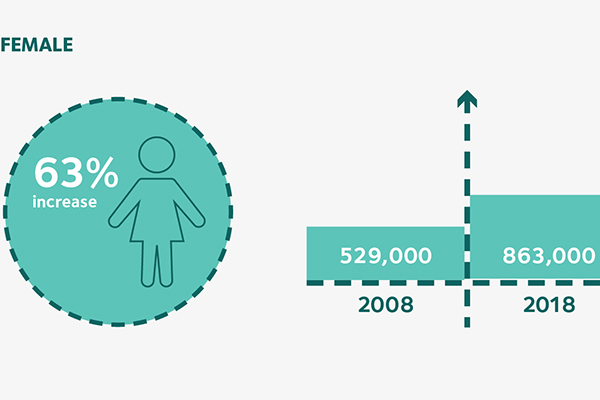

Many mothers turn to self-employment to allow flexible working. Figures released today by The Association for Independent Professionals and the Self-Employed (IPSE), showed that since 2008, the number of working mothers has grown by 54 per cent.

Number of freelancers reaching retirement age increases

IPSE’s report also found that the self-employed population is reaching retirement age. The study revealed an increase of more than half (51%) in the number of freelancers aged 40 and above, from 2008-2018. A further 20 per cent of these are over-sixty.

This coincides with figures obtained from HMRC by Telegraph Money, which revealed that 1.8 million people over the age of 65 filed a return for the 2017-18 tax year, compared to 1.7 million in 2015-16.

Self-employed pensioners often fall into the self-assessment net, as their earnings on top of a pension exceed the personal allowance (£12,500 for the current tax year). This means self-employed freelancers often feel the pinch when it comes to self-assessment tax returns.

Pensions can be particularly challenging for the self-employed

IPSE’s public affairs manager, Jonathan Lima-Matthews, commented: “The low levels of self-employed people with a pension may be because of the nature of fluctuating incomes in freelancing. Self-employed people tend to have a more varied income- some months with big earnings, and others with little.

“Therefore, the self-employed may wish to keep their savings in more accessible accounts rather than less flexible pensions which have penalties for early withdrawals. This can be in case of problems with late payments, or a slow work month. IPSE calls for the sidecar pension to be introduced to the self-employed as this is the flexible solution they are calling for”.

Freelance Corner has compiled a guide to help freelancer’s save for later life.